What is a Soft Credit Inquiry: Everything You Need To Know

Dec 12, 2022 By Triston Martin

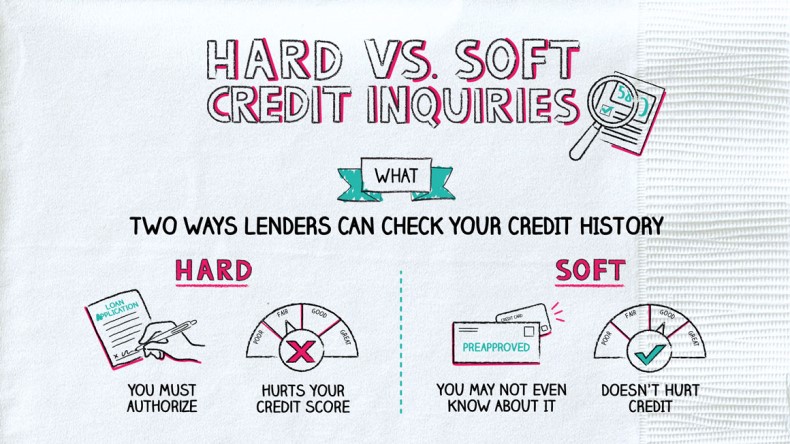

Credit checks can be scary for people who want to keep or improve their credit scores. Your credit score shows banks and other banks how well you have utilized credit. This helps them decide how risky it is to lend you money. Your credit score could go down if you get a lot of new credit checks. Not all of them do, though. Hard ones do, but soft ones don't. However, you may have further questions concerning credit checks, like what is a soft credit inquiry, how they function, and how they vary from hard pulls.

What Is A Soft Credit Check?

"Soft credit inquiries" is a common term for soft credit checks. "Soft credit pulls" and "Hard credit pulls" are ways financial institutions and lenders, like credit card companies, check your credit to see how good it is. A "soft credit check" is when someone checks your credit report without permission but does not decide whether to give you new credit.

The ones that happen after you apply for credit are called "hard inquiries." On the other hand, soft inquiries are usually used to find out information or get permission ahead of time. Be sure to ask your banker or lender before you fill out an application if there will be a soft or hard credit check. This is because each lender has its own set of rules.

What Effect Does A Soft Credit Inquiry Have On Your Credit Score?

A soft credit inquiry may appear on your credit report from one of the three main credit bureaus, but it won't affect your credit score. So, you don't have to worry about soft credit checks because they won't stop you from building and keeping good credit.

While regarding the other concern (how do credit inquiries work?), a hard inquiry is an inquiry that directly affects your credit score. It's important to know what a hard credit check is and how it's different from a soft credit check if you want to build your credit. It also tells you how lenders use your credit report, both before and after you apply for new credit.

Things That Can Make A Soft Credit Check Occur

Several things can lead to a soft credit inquiry, such as:

- Lenders check your credit, whether you ask them to or not, to see if they can pre-approve you for a new credit card, loan, mortgage, or another type of loan

- Employers sometimes check your credit when you apply for a job or as part of a background check

- You can check your credit score or credit report

- Services that check your credit Check your credit reports to see if anything strange has happened

Soft vs Hard Credit Check

Let us discuss how do credit work what are hard inquiries? Soft and hard credit checks are different in many ways. When you ask a lender, bank, or other financial institution for a personal loan, auto loan, or line of credit, they will often do a hard credit check. If you know someone is checking your credit, ask if it's a hard pull or a soft pull. You might be able to ask for a soft credit check in some situations.

When you get a hard credit check, it changes your credit score. A hard credit check could lower your score by up to 10 points, but it usually only drops a few points. These hard credit pulls only stay on your credit report for a short time. After two years, they are gone. Through a process called "deduping," hard credit checks for the same type of new credit done more than once in a certain amount of time are put together. This is meant to make it easier for people to compare loan rates and find the best ones."

Utilize Careful Credit Management

It's important to know how credit works if you want to plan and handle your money well. Part of this knows the difference between soft and hard credit checks, especially when looking into new credit products like loans, credit cards, mortgages, and more. It is important to know what kind of credit check is being done so you can figure out how it might affect your score.

Again, soft inquiries won't hurt your credit score, so you don't have to worry about them. This is good news for people who want to build and keep good credit scores and become more creditworthy.

Will I Get A Hard Inquiry If I Check My Credit Score?

No. This is known as a "soft credit check" and will not harm your credit score. Credit Karma allows you to check your VantageScore 3.0 credit scores from Equifax and TransUnion for free and as frequently as possible without negatively impacting your credit scores.